Stock Market Outlook For The Week of

March 25th = Downtrend

INDICATORS

20/50 Day Moving Averages: Downtrend

Price & Volume Action: Downtrend

Objective Elliott Wave Analysis: Downtrend

Another quarter-point rate hike from the Fed paled in comparison to Thursday's announcement of U.S. plans for intellectual property tariffs on up to $60 billion of high-tech goods from China. There's a good chance the tariffs are a negotiating ploy, but that won't stop knee-jerk reactions in the stock market. Technology stocks also faced selling pressure, associated with Facebook's recent data privacy issues. For the week, the indexes lost between 5% and 6%, give or take.

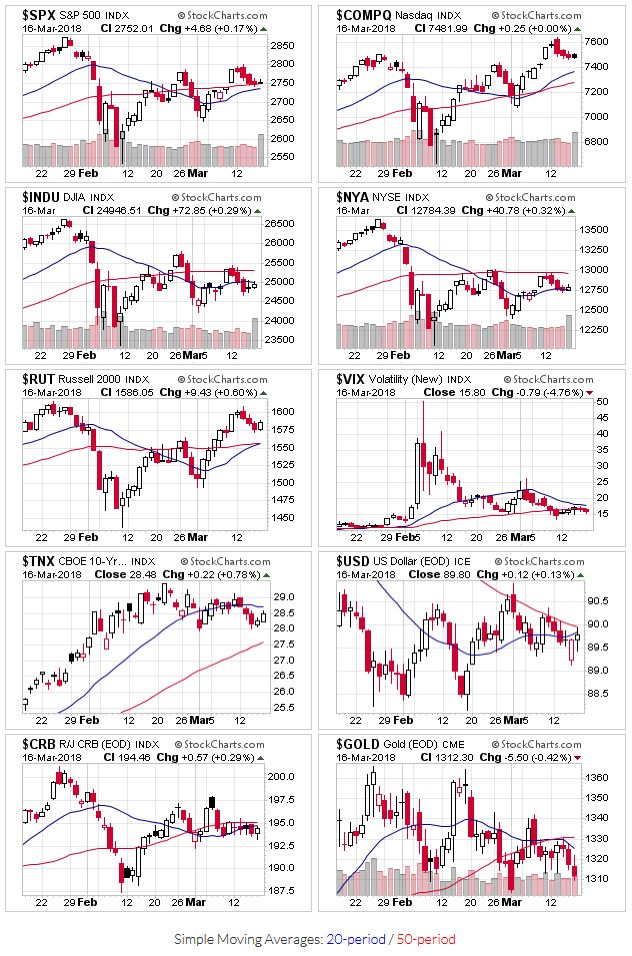

All the indexes start this week below their 20 and 50 day moving averages, putting the moving average signal back into downtrend territory. The S&P rests on its 200 day moving average, with the other indexes within striking distance. Prior to this year, the S&P500 hasn't touched the 200 day since the US election in 2016.

2018-03-25-US Stock Market Averages

Price and volume action also fell back into downtrend territory due to high volume selling during the week and prices dropping below the 50-day moving average.

OEW updated the wave count to reflect the sell off last week, putting the current signal back into downtrend territory.

It appears that the previous "uptrend" was really just a corrective "rally" in an ongoing downtrend. As I mentioned last week, this type of whipsaw action is one of the reasons I'm looking for another indicator that is more accurate during periods of volatility.

2018-03-25 - SPX Technical Analysis

Last week, the ADX was showing a weakening bearish trend (DI- was higher than DI+ but the ADX was declining). This week, we have a strengthening bearish trend (DI- higher than DI+ and the ADX is rising). Combined with a break below the 50 day moving average on higher volume (Monday's price action), and a sell signal would have been generated on Monday.After a week of selling, markets are usually considered "oversold". That's not an invitation to buy, because markets can continue to sell off. But be on the lookout for high volume buying when institutional investors cover their short positions and/or buy the dip. Until then, check your stops, cut your losses, and update your watch list with stocks that are resisting the current weakness.

If you find this research helpful, please tell a friend. If you don't find it helpful, tell an enemy. I share articles and other news of interest via Twitter; you can follow me @investsafely. The weekly market outlook is also posted on Facebook and Linkedin.

You can check out how well (or poorly) the outlook has tracked the market using past performance estimates:

- 2015 Performance - Stock Market Outlook

- 2016 Performance - Stock Market Outlook

- 2017 Performance - Stock Market Outlook

For the detailed Elliott Wave Analysis, go to the ELLIOTT WAVE lives on by Tony Caldaro. Charts provided courtesy of stockcharts.com.