Stock Market Outlook For The Week of

December 30th = Downtrend

INDICATORS

20/50 Day Moving Averages: Downtrend

Price & Volume Action: Downtrend

Objective Elliott Wave Analysis: Downtrend

Better late than never? We had to wait until after Christmas, but Santa Claus delivered a rally. Not as much as we would have liked, I'm sure, but better than another sell-off. No change in outlook though. Equities have some work to do before giving the all clear to put your money at risk.

On the bright side, I don't think we're in danger of a 2008-2009 style sell off just yet (see last week's article "Great Recession Revisited"), so your portfolios should recover a bit.

All the indexes are well below their 20, 50, and 200 day moving averages.

2018-12-30 - US Stock Market Averages

The price/volume combo remains in a downtrend as well. There are only a handful of names on my growth stock list that have anything even close to resembling a solid price chart.

OEW still calls for a downtrend, and thinks we could take another run at the lows. But, per their analysis, that could be the end of the downtrend...even the bear market(!).

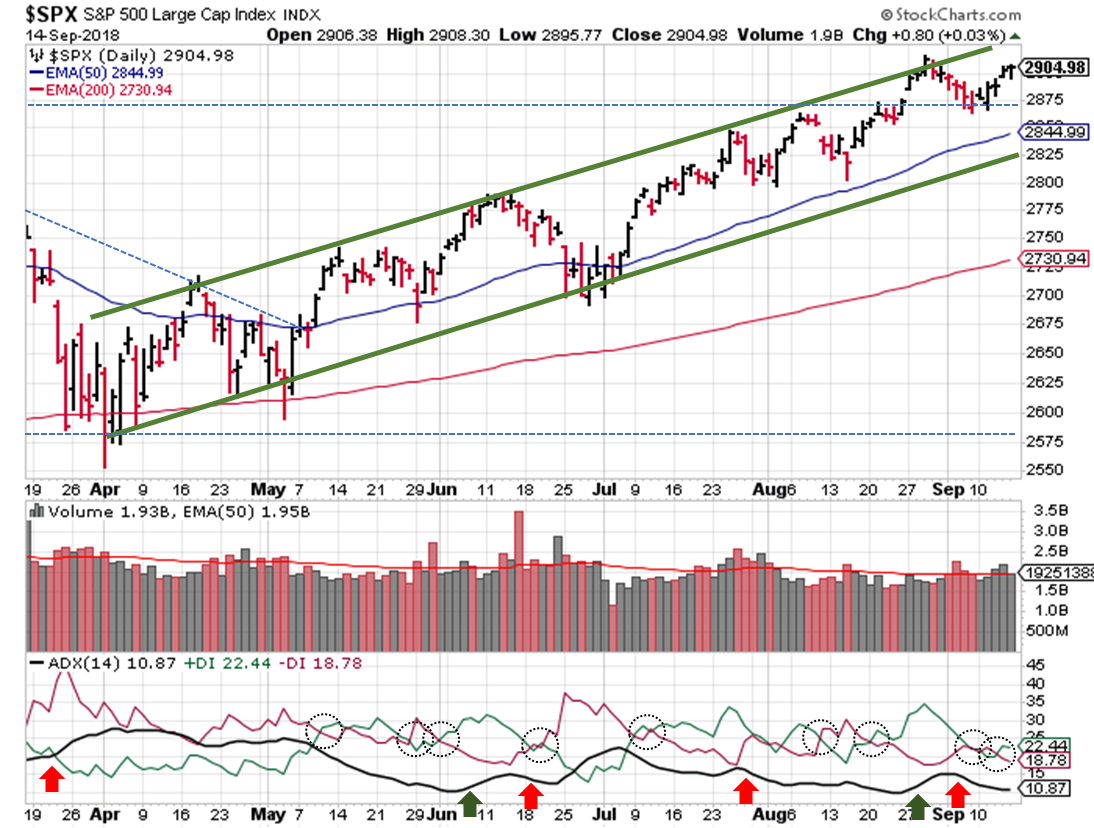

The S&P ($SPX) found support around 2,350, and looks to have broken the falling trendline in play for most of December. Prices still have to recover ~10% just to get back to the downward trendline and/or 200-day moving average! The ADX reflects the bearish we experienced last week.

2018-12-30 - SPX Technical Analysis - Daily

Switching to a weekly view, the 2395 support level held and prices are resting on the 2480 support/resistance level.

2018-12-30 - SPX Technical Analysis - Weekly

After the bounce back, bulls will say we're a week into a V-shaped recovery. The bears will say we need another test of the lows to truly bottom. Our job is to make money or not to lose a lot if we decide to initiate positions.

We've got another holiday shortened trading week coming up as we celebrate the new year.

Wishing you investing success in 2019!

Happy New Year!

If you find this research helpful, please tell a friend. If you don't find it helpful, tell an enemy. I share articles and other news of interest via Twitter; you can follow me @investsafely. The weekly market outlook is also posted on Facebook and Linkedin.

You can check out how well (or poorly) the outlook has performed as a stand-alone, signal generator using past performance estimates:

- 2015 Performance - Stock Market Outlook

- 2016 Performance - Stock Market Outlook

- 2017 Performance - Stock Market Outlook

For the detailed Elliott Wave Analysis, go to the ELLIOTT WAVE lives on by Tony Caldaro. Charts provided courtesy of stockcharts.com.